Reverse Mortgage Ottawa: Empowering Your Retirement with Home Equity

The Reverse Mortgage for Canadians 55 and over

Thousands of 55+ Canadians are beginning to realize just how wealthy they are, when they consider the equity they’ve built in their homes

- Access up to 55% of your home value in tax-free cash!

- Keep the home you love

- No monthly mortgage payments

WE’RE HERE TO HELP

What is a Reverse Mortgage in Ottawa?

A reverse mortgage is a financial tool that allows Canadian homeowners aged 55+ to convert a portion of their home’s equity into tax-free cash. Unlike traditional mortgages, there are no monthly payments. Repayment only occurs when the home is sold, you move out permanently, or pass away. For more details, visit the Financial Consumer Agency of Canada.

Benefits of a Reverse Mortgage

- No Monthly Payments: Stay in your home without the burden of monthly mortgage payments.

- Access Up to 55% of Your Home’s Value: Unlock your home’s value while still living in it.

- Remain Homeowner: Continue to own your home while using your equity to support your lifestyle.

Reverse mortgages provide flexibility and financial security for homeowners looking to leverage their home equity during retirement.

Why Consider a Reverse Mortgage?

- With more than 21.8% of Canadians approaching retirement, many face challenges with limited pension income and rising costs. A reverse mortgage offers a solution to supplement income without the need to sell or downsize, making it an attractive option for financial stability in retirement.

Reverse Mortgage Statistics in Ottawa (2023)

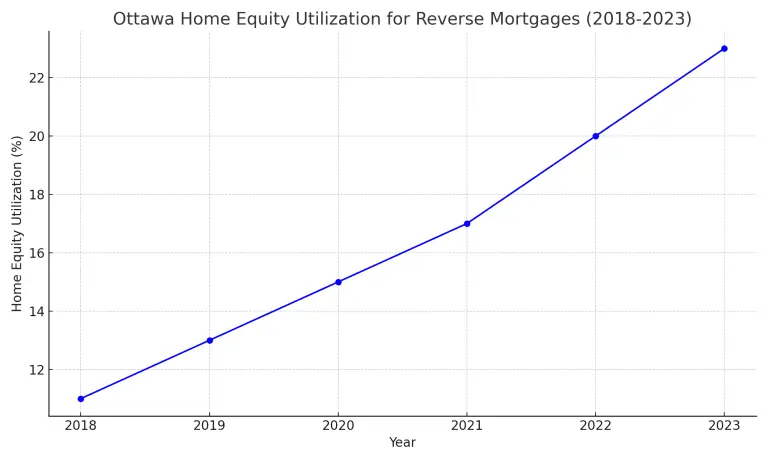

Graph: Reverse Mortgage Ottawa Home Equity Utilization for Reverse Mortgages (2018-2023):

This graph highlights the growing percentage of home equity used by Ottawa homeowners for reverse mortgages from 2018 to 2023. More seniors are turning to reverse mortgages to leverage their home equity for financial stability in retirement.

How Does a Reverse Mortgage Work in Ottawa?

A reverse mortgage enables homeowners to receive cash based on a percentage of their home’s appraised value. The payment options include:

- Lump Sum Payments: Receive all the funds upfront.

- Scheduled Advances: Get periodic payments over time, similar to an income stream.

- Combination: A mix of lump sum and periodic payments.

For detailed information, consult the Government of Canada’s reverse mortgage guide.

Reverse Mortgage Qualification Criteria in Ottawa

To qualify for a reverse mortgage in Ottawa, you must meet the following requirements:

- You must be 55 years or older.

- Your home must be your primary residence.

- You can borrow up to 55% of your home’s appraised value, depending on your age, the value of your home, and its location.

Reverse Mortgage vs. Other Financial Options

| Product | Reverse Mortgage | HELOC (Home Equity Line of Credit) | Personal Loan |

|---|---|---|---|

| Repayment Terms | When the home is sold | Monthly repayments | Monthly repayments |

| Interest Rates | Higher than regular rates | Lower variable rates | Variable rates |

| Monthly Payments | None | Required | Required |

| Income Requirements | No | Yes | Yes |

A reverse mortgage offers a unique advantage: no monthly payments, allowing you to maintain cash flow without financial strain.

Reverse Mortgage Interest Rates in Ottawa 2024

Reverse mortgage rates tend to be about 2% higher than traditional mortgage rates, ranging from 7% to 10%. These higher rates reflect the risk for lenders, as no payments are required until the loan is repaid.

To stay informed on mortgage rate trends, visit the Bank of Canada’s website.

You can also check the latest reverse mortgage rates by visiting one of Canada’s top rate comparison sites, Rates4u.

Who Should Consider a Reverse Mortgage?

- Retirees Needing Extra Income: Supplement your retirement income without having to sell your home.

- Homeowners Looking to Avoid Monthly Payments: With no monthly payments required, a reverse mortgage offers peace of mind.

- Seniors Who Want to Age in Place: Continue living in your home while accessing its value.

Get An Estimate

See How Much You Can Borrow Today!

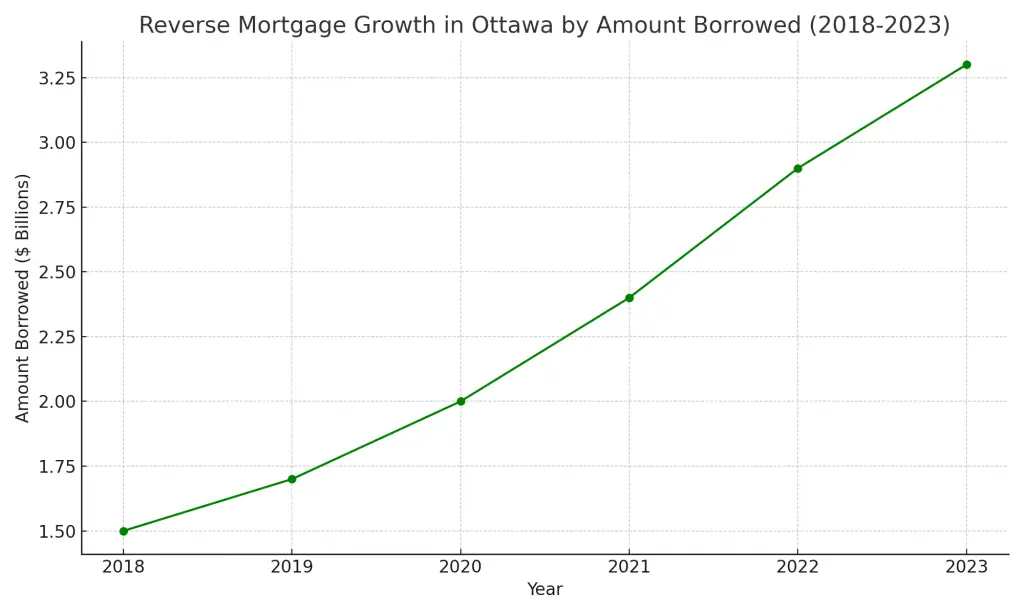

Graph: Reverse Mortgage Ottawa: Growth in Ottawa by Amount Borrowed (2018-2023):

This chart illustrates the steady rise in reverse mortgage borrowing in Ottawa. As the total amount borrowed continues to grow, more Ottawa homeowners are choosing reverse mortgages to access their home equity.

Alternatives to a Reverse Mortgage

If a reverse mortgage isn’t right for you, consider these alternatives:

- HELOC (Home Equity Line of Credit): Offers lower interest rates but requires monthly payments.

- Downsizing: Selling your home and moving into a smaller property.

- Cash-Out Refinance: Increases the size of your mortgage, allowing you to access your home’s equity.

Reverse Mortgage Fees and APR

When considering a reverse mortgage, it’s essential to understand all associated costs:

- Setup Fee: Lenders may charge a one-time setup fee (e.g., $995).

- Appraisal Fee: To determine your home’s market value.

- Legal Fees: For independent legal advice and documentation.

- Administration Fees: Ongoing fees for managing the mortgage.

Understanding APR

The Annual Percentage Rate (APR) includes the interest rate plus other charges, giving you a comprehensive view of the loan’s cost. It’s crucial to compare APRs between lenders to understand the true cost of borrowing.

Is a Reverse Mortgage a Good Idea?

A reverse mortgage can be beneficial, but it’s important to weigh the pros and cons.

Pros:

- Provides tax-free cash without selling your home.

- No monthly mortgage payments required.

- Flexibility in how you receive the funds.

- You retain ownership of your home.

Cons:

- Higher interest rates than traditional mortgages.

- The loan balance increases over time due to accumulating interest.

- Reduces the amount of equity available to your estate.

- Fees and closing costs can be significant.

Before proceeding, consider your financial goals, consult with us at Citadel Mortgages to review all your options.

FAQ: Common Questions about Reverse Mortgages in Ottawa

Your estate or heirs must repay the loan through the home’s sale or other financial means.

Interest is applied to the amount you borrow and is compounded over time, meaning it adds to the loan balance until repayment.

No, you keep ownership as long as property taxes, home maintenance, and insurance are kept up to date.

You can access up to 55% of your home’s value, depending on factors like your age and home value.

No, reverse mortgage payments are tax-free, and they won’t impact your Old Age Security (OAS) or Guaranteed Income Supplement (GIS).

Expect costs like appraisal fees, legal fees, and administrative charges, which vary by lender.

Yes, you can sell your home at any time, but the reverse mortgage balance must be repaid from the proceeds.

Yes, most lenders allow early repayment, though penalties may apply depending on the contract terms.

Reverse Mortgage Rates in Ottawa

Success Stories

Case Study 1: Helen, Age 75

Helen wanted to renovate her home to make it more accessible but didn’t have the funds. A reverse mortgage allowed her to access $120,000 of her home equity, enabling her to install a stairlift and remodel her bathroom. She can now live comfortably in her home without the stress of monthly payments.

Case Study 2: Robert and Linda, Ages 68 and 70

Facing rising medical expenses, Robert and Linda needed additional income. They obtained a reverse mortgage, providing them with a monthly payment that supplemented their pensions. This financial relief allowed them to focus on their health and well-being.

Understanding Reverse Mortgage Costs in Ottawa

Reverse mortgages include several costs beyond the interest rate:

- Processing Fees: Charges for setting up the mortgage, which may be a flat fee or based on the loan amount.

- Closing Costs: Fees associated with finalizing the mortgage, such as legal and administrative fees.

- Independent Legal Advice (ILA): Some lenders require you to obtain legal advice, which can cost between $350 to $500.

Why Are Interest Rates Higher for Reverse Mortgages?

Reverse mortgages pose more risk to lenders since repayment isn’t required until the future, and borrowers make no monthly payments. To offset this risk, lenders charge higher interest rates compared to traditional mortgages.

How Is Interest Calculated on a Reverse Mortgage in Ottawa?

Interest is only charged on the amount you borrow, not the maximum amount available. It accrues daily and is compounded semi-annually for fixed rates or monthly for variable rates.

Example Calculation

- Home Value: $500,000

- Borrowed Amount: $100,000

- Interest Rate: 4.89% annually

Steps:

- Daily Interest Rate: 4.89% ÷ 365 = 0.0134% per day

- Daily Interest Charge: $100,000 × 0.0134% = $13.40

- Interest Over Six Months: $13.40 × 180 days = $2,412

- New Balance After Six Months: $100,000 + $2,412 = $102,412

- Compound Interest: Interest now calculated on $102,412

After one year, the total interest accrued would be approximately $4,900, and the loan balance would be around $104,900.

How is compound interest applied on Reverse Mortgages?

After six months, compound interest takes effect, meaning the interest is charged not just on the principal loan but on the accumulated interest. For example:

- Second six-month daily interest: $102,444 x 0.01358% = $13.91/day.

- Interest for another six months: $13.91/day x 180 days = $2,504.

Adding this to the outstanding balance of $102,444 gives a new loan balance of $104,948.

Thus, after one year, the total interest would amount to $4,948 on a $100,000 reverse mortgage with a 4.89% interest rate.

Get An Estimate

See How Much You Can Borrow Today!

Protections for Borrowers Of Reverse Mortgages

Both HomeEquity Bank CHIP and Equitable Bank Flex guarantee that borrowers won’t owe more than the value of their home when it’s sold. This means that even if the home’s value decreases, you will never have to make up the difference if the mortgage balance exceeds the home’s sale value. For instance, if you borrow $275,000 against a home worth $500,000 and the home’s value drops, you are still protected by the “no negative equity” guarantee.

These terms and the method of compounding interest highlight the importance of understanding how interest and fees accumulate over time in reverse mortgages.

Contact Us for a Free Consultation

Our team is here to help you navigate your options. Contact us today for personalized advice on whether a reverse mortgage is right for you.

Citadel Mortgages is one of Canada’s leading brokerages specializing in reverse mortgages. Visit Citadel Mortgages to learn more today.

Reverse Mortgage Rates Ottawa

Reverse Mortgage Explainer Video

Unlock the value in your home and turn it to cash to help you enjoy life on your terms. Inquire about your reverse mortgage today.

Get Your Estimate

Reverse Mortgage Calculator: Estimate How Much You Can Borrow

Are you curious about how much you could access from your home equity with a reverse mortgage? Use our simple and intuitive Reverse Mortgage Calculator to get an estimate of how much you could borrow based on your home’s current value, your age, and other factors. This tool can help you better understand your financial options and decide whether a reverse mortgage is right for you.

How the Reverse Mortgage Calculator Works:

- Enter Your Home’s Current Value: The estimated market value of your property.

- Select Your Age: The older you are, the more you can borrow. If you have a spouse, include both ages.

- Choose Your Location: Property location affects your borrowing power, as home values vary by region.

- See Your Estimated Loan Amount: The calculator will provide a projection of the maximum amount you may qualify for.

Reverse Mortgage Calculator Ottawa

See How Much You Can Borrow Today!